Enhance Your Foreign Exchange Offers: Currency Exchange in Toronto Revealed

Enhance Your Foreign Exchange Offers: Currency Exchange in Toronto Revealed

Blog Article

Reveal the Tricks to Making Smart Decisions in Money Exchange Trading

In the fast-paced globe of money exchange trading, the ability to make educated decisions can be the difference between success and failure. As investors navigate the intricacies of the market, they frequently choose evasive tricks that can give them a side. Recognizing market trends, applying reliable danger management methods, and evaluating the interaction between technical and fundamental factors are simply a few elements that contribute to making clever decisions in this sector. There are deeper layers to discover, including the psychology behind trading decisions and the application of innovative trading tools. By peeling off back the layers of this elaborate landscape, traders might reveal surprise understandings that could potentially change their strategy to currency exchange trading.

Recognizing Market Fads

An extensive comprehension of market trends is crucial for successful money exchange trading. Market fads describe the general direction in which the market is conforming time. By recognizing these patterns, traders can make more enlightened choices regarding when to purchase or sell money, inevitably optimizing their profits and reducing potential losses.

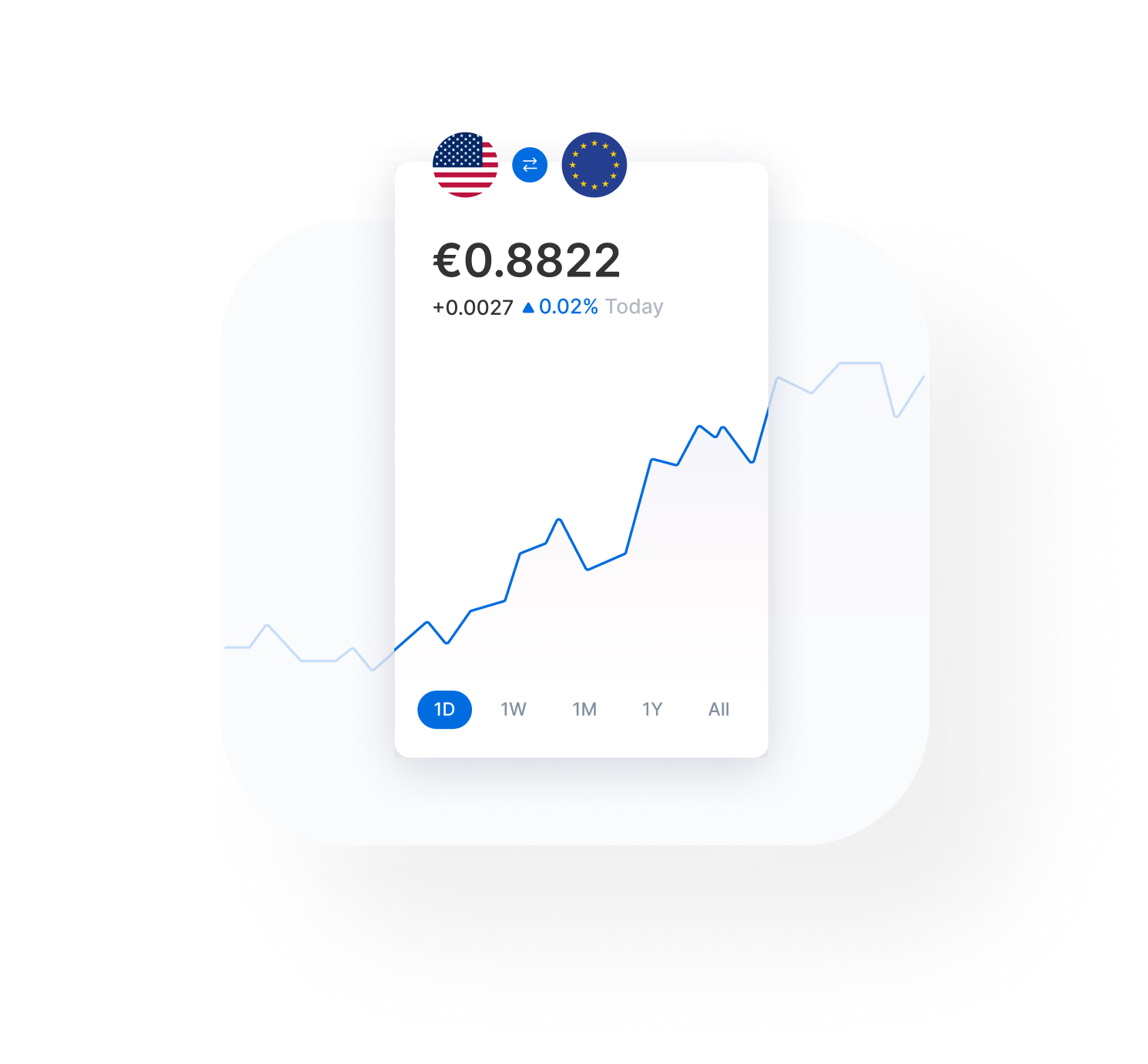

To effectively assess market fads, traders typically use technical evaluation, which includes examining historical price graphes and utilizing various indications to anticipate future cost motions. currency exchange in toronto. Essential evaluation is additionally vital, as it includes examining economic signs, political events, and various other elements that can influence money worths

Danger Administration Approaches

Exactly how can money exchange traders effectively alleviate potential dangers while optimizing their financial investment chances? One vital method is establishing stop-loss orders to limit losses in instance the market moves against a trader's setting. By specifying the maximum loss they are prepared to bear upfront, traders can secure their capital from considerable recessions.

Additionally, leveraging devices like hedging can even more protect investors from negative market motions. Hedging entails opening up a position to counter prospective losses in one more setting, therefore lessening total danger. Keeping up with financial signs, geopolitical events, and market sentiment is also vital for making notified choices and changing methods appropriately. Ultimately, a calculated and regimented method to risk management is critical for lasting success in money exchange trading.

Basic Vs. Technical Analysis

Some investors like fundamental evaluation for its emphasis on macroeconomic factors that drive money values, while others favor technological evaluation for its emphasis on rate patterns and patterns. By integrating technical and basic analysis, traders can make even more educated choices and improve their total trading efficiency - currency exchange in toronto.

Leveraging Trading Devices

With a solid structure in essential and technical analysis, money exchange traders can significantly improve their decision-making process by leveraging different trading devices. These tools are designed to supply investors with valuable understandings right into market trends, rate movements, and prospective access or departure factors. One vital trading device is the economic calendar, which aids traders track vital financial occasions and statements that could affect money values. By remaining notified concerning essential financial signs such as rates of interest, GDP reports, and work numbers, traders can make even more enlightened choices concerning their trades.

Psychology of Trading

Recognizing the mental facets of trading is important for money exchange investors to navigate the psychological challenges and prejudices that can affect their decision-making procedure. The psychology of trading explores the attitude of traders, addressing concerns such as worry, greed, insolence, and impulsive find actions. Emotions can shadow judgment, leading traders to make illogical decisions based upon feelings instead of logic and evaluation. It is essential for investors to cultivate psychological self-control and maintain a reasonable approach to trading.

One common emotional catch that traders come under is verification bias, where they look for details that supports their presumptions while disregarding inconsistent proof. This can impede their capacity to adapt to changing market problems and make educated decisions. Additionally, the worry of missing out on out (FOMO) can drive investors to go into professions impulsively, without performing correct research or analysis.

Conclusion

To conclude, mastering the art of currency exchange trading needs a deep understanding of market patterns, efficient danger administration approaches, expertise more of fundamental and technical analysis, application of trading tools, and recognition of the psychology of trading (currency exchange in toronto). By incorporating these components, investors can make enlightened choices and boost their possibilities of success in the unstable world of currency trading

By peeling off back the layers of this detailed landscape, investors may uncover hidden understandings that can possibly change their strategy to money exchange trading.

With a solid foundation in technical and fundamental evaluation, money exchange traders can significantly boost their decision-making procedure by leveraging different trading tools. One crucial trading device is the economic schedule, which aids traders track important economic occasions and statements that could influence currency worths. By leveraging these trading devices in conjunction with technical and basic analysis, currency exchange investors can make smarter and much more tactical trading choices in the dynamic foreign exchange market.

Comprehending the psychological elements of trading is important for money exchange traders to browse the emotional obstacles and predispositions that can influence their decision-making process.

Report this page